60-Second Video Market Updates

Posted by Bill True on

Berkshire Hathaway HomeServices Hilton Head Bluffton Realty is pleased to offer these professional and dynamic 60-second market updates for our clients. The videos touch on 5 key components of market activity: Active Inventory, Median Listing Price, Days on the Market, Median Sales Price, Units Sold. Open the Full post to click Video Links.

- Sea Pines

- Palmetto Dunes & Shelter Cove

- Forest Beach

- Shipyard

- Folly Field, Hilton Head

- Hilton Head Plantation

- Windmill Harbour

- Long Cove

- Hilton Head Condos ($250K+)

- Hilton Head Luxury Homes

- Bluffton

- Oldfield

- Sun City

- Latitude Margaritaville

-

Bluffton Luxury Homes

Our goal with these fact-based videos is to…

4162 Views, 0 Comments

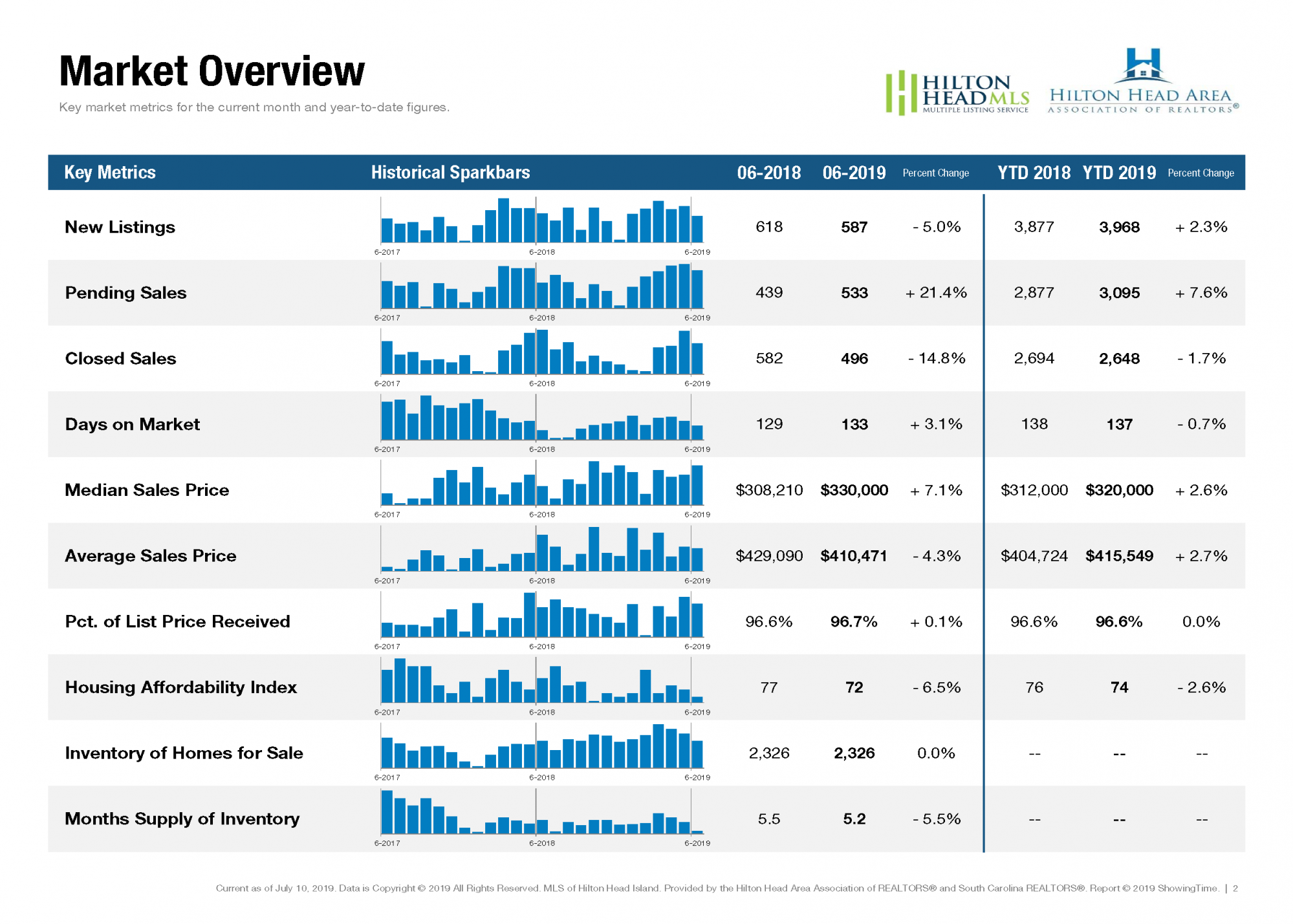

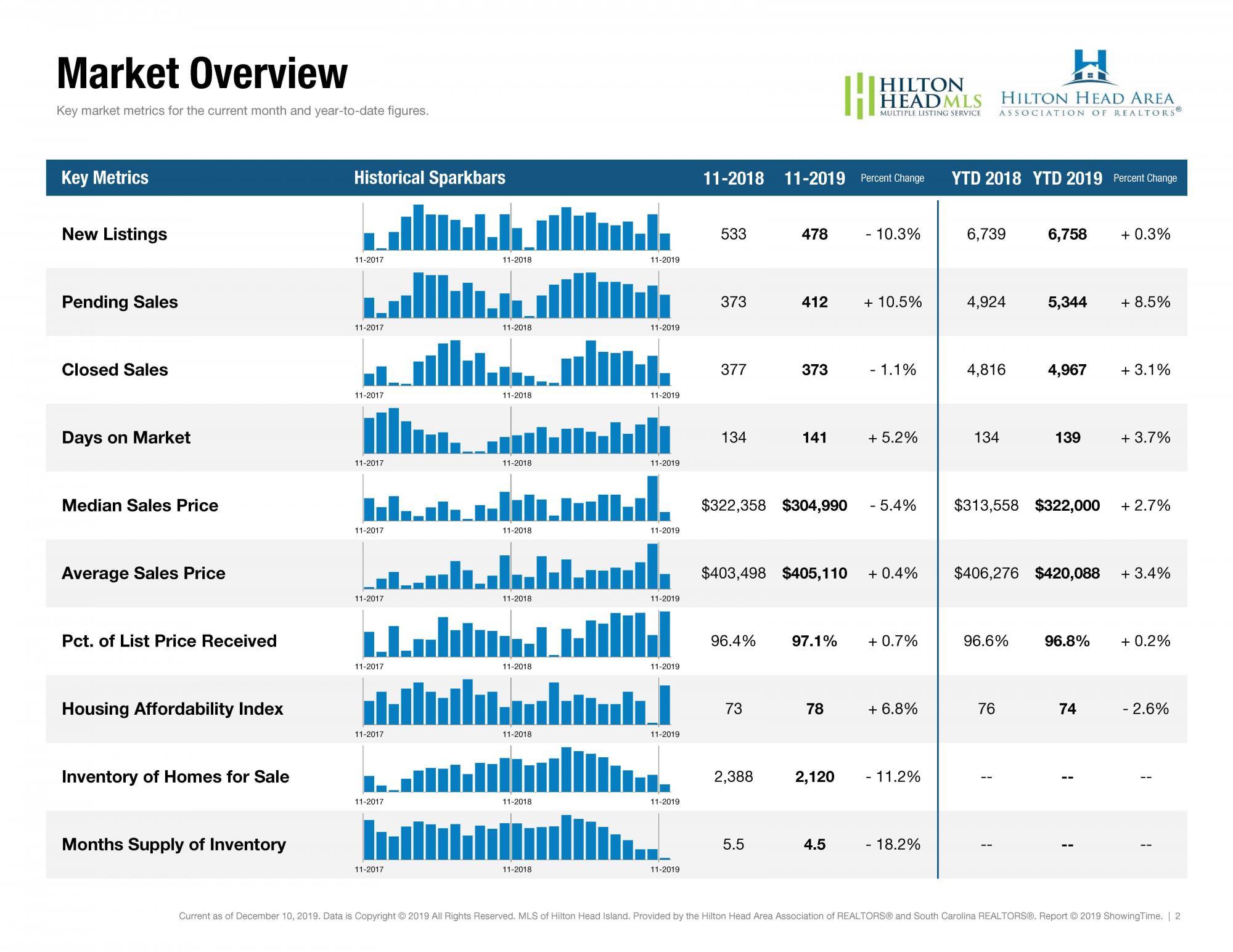

In November, the Federal Reserve reduced its benchmark rate for the third time this year. This action was widely anticipated by the market. Mortgage rates have remained steady this month and are still down more than 1 percent from last year at this time. Residential new construction activity continues to rise nationally. The U.S. Commerce Department reports that new housing permits rose 5% in October to a new 12-year high of 1.46 million units.

In November, the Federal Reserve reduced its benchmark rate for the third time this year. This action was widely anticipated by the market. Mortgage rates have remained steady this month and are still down more than 1 percent from last year at this time. Residential new construction activity continues to rise nationally. The U.S. Commerce Department reports that new housing permits rose 5% in October to a new 12-year high of 1.46 million units.