As was widely expected, the Federal Reserve did not change the target range for the federal funds rate – currently set at 2.25 to 2.5 percent – during their June meeting. Although the economy is still performing well due to factors such as low unemployment and solid retail sales, uncertainty remains regarding trade tensions, slowed manufacturing and meek business investments.

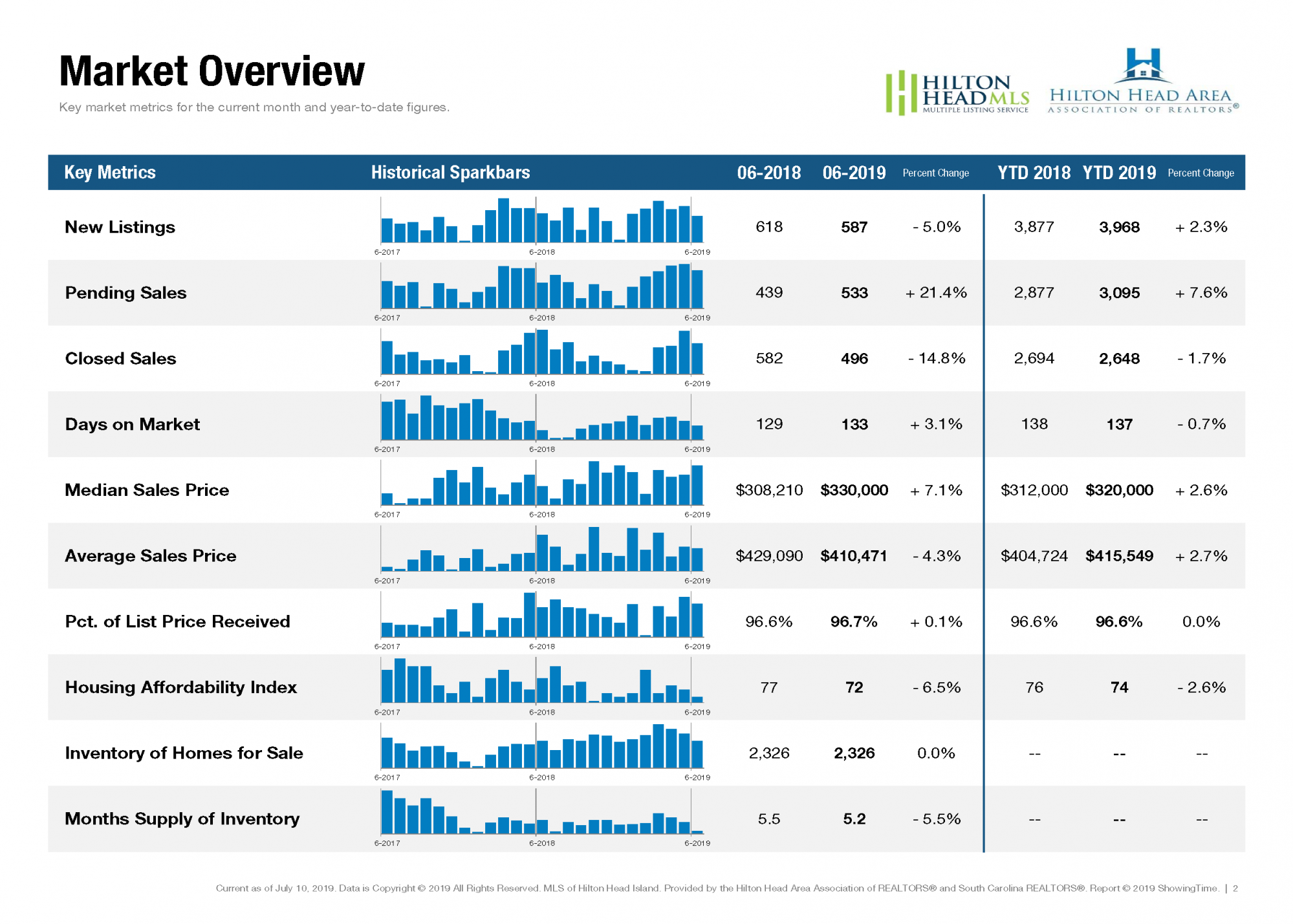

New Listings were down 5.0 percent to 587. Pending Sales increased 21.4 percent to 533. Inventory remained flat at 2,326. Prices moved higher as Median Sales Price was up 7.1 percent to $330,000. Days on Market increased 3.1 percent to 133 days. Months Supply of Inventory was down 5.5 percent to 5.2 months, indicating that demand increased relative to supply.

In terms of relative balance between buyer and seller interests, residential real estate markets across the country are performing well within an economic expansion that will become the longest in U.S. history in July. However, there are signs of a slowing economy. The Federal Reserve considers 2.0 percent a healthy inflation rate, but the U.S. is expected to remain below that this year. The Fed has received pressure from the White House to cut rates in order to spur further economic activity, and the possibility of a rate reduction in 2019 is definitely in play following a string of increases over the last several years.

Please contact us for additional information and individual community market reports.

Posted by Christina Galbreath-Gonzalez on

Leave A Comment