Some economy observers are pointing to 2018 as the final period in a long string of sentences touting several happy years of buyer demand and sales excitement for the housing industry. Although residential real estate should continue along a mostly positive line for the rest of the year, rising prices and interest rates coupled with salary stagnation and a generational trend toward home purchase delay or even disinterest could create an environment of declining sales.

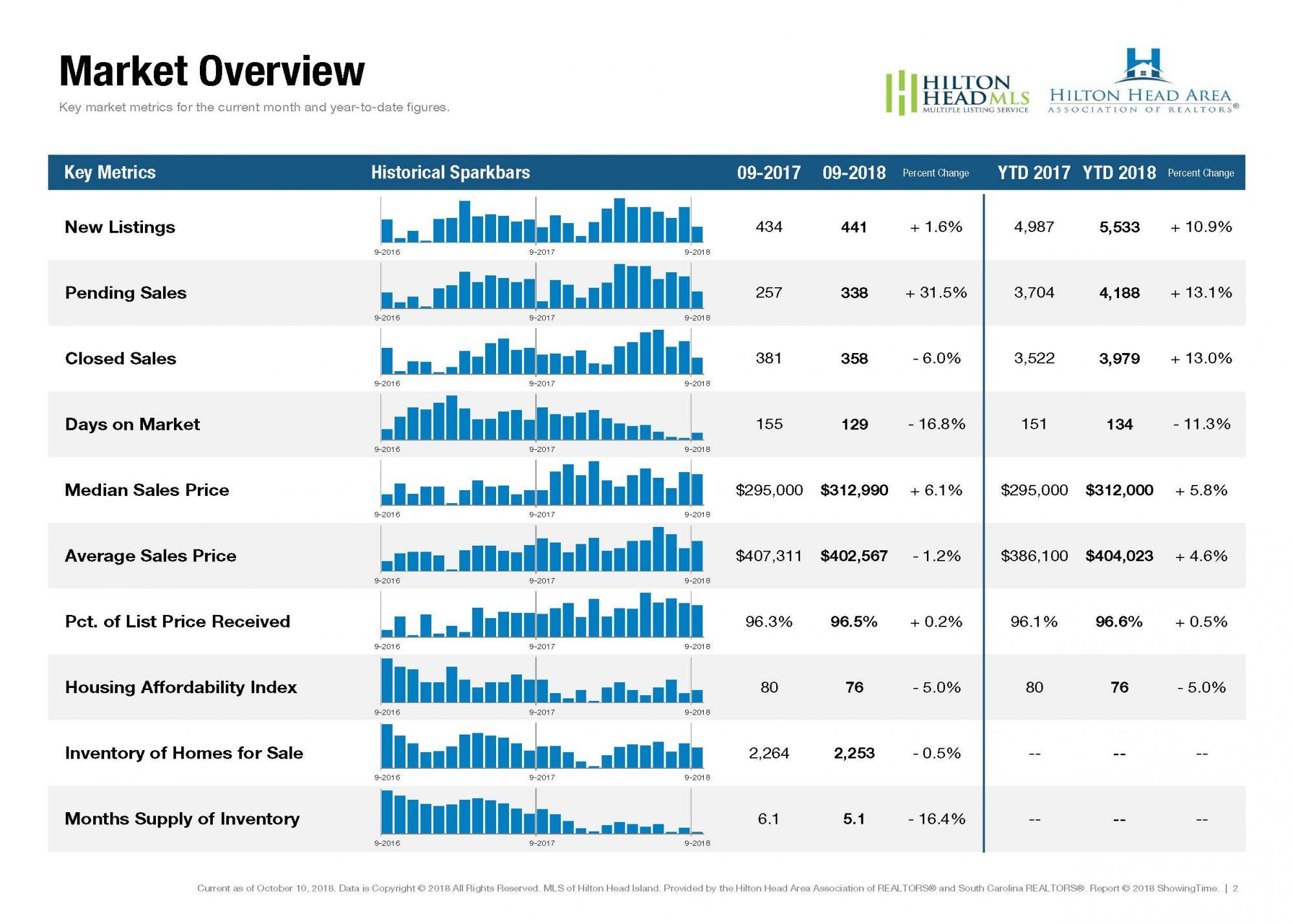

New Listings were up 1.6 percent to 441. Pending Sales increased 31.5 percent to 338, the eighth consecutive month of year-over-year gains. Inventory shrank 0.5 percent to 2,253 units.

Prices moved higher as Median Sales Price was up 6.1 percent to $312,990. Days on Market decreased 16.8 percent to 129 days. Months Supply of Inventory was down 16.4 percent to 5.1 months, indicating that demand increased relative to supply.

Tracking reputable news sources for housing market predictions makes good sense, as does observing trends based on meaningful statistics. By the numbers, we continue to see pockets of unprecedented price heights combined with low days on market and an economic backdrop conducive to consistent demand. We were reminded by Hurricane Florence of how quickly a situation can change. Rather than dwelling on predictions of a somber future, it is worth the effort to manage the fundamentals that will lead to an ongoing display of healthy balance.

Leave A Comment