The booming U.S. economy continues to prop up home sales and new listings in much of the nation, although housing affordability remains a concern. Historically, housing is still relatively affordable. Although Freddie Mac recently reported that the 30-year fixed rate is at its highest average in seven years, reaching 4.94 percent, average rates were 5.97 percent ten years ago, 6.78 percent 20 years ago and 10.39 percent 30 years ago. Nevertheless, affordability concerns are causing a slowdown in home price growth in some markets, while price reductions are becoming more common.

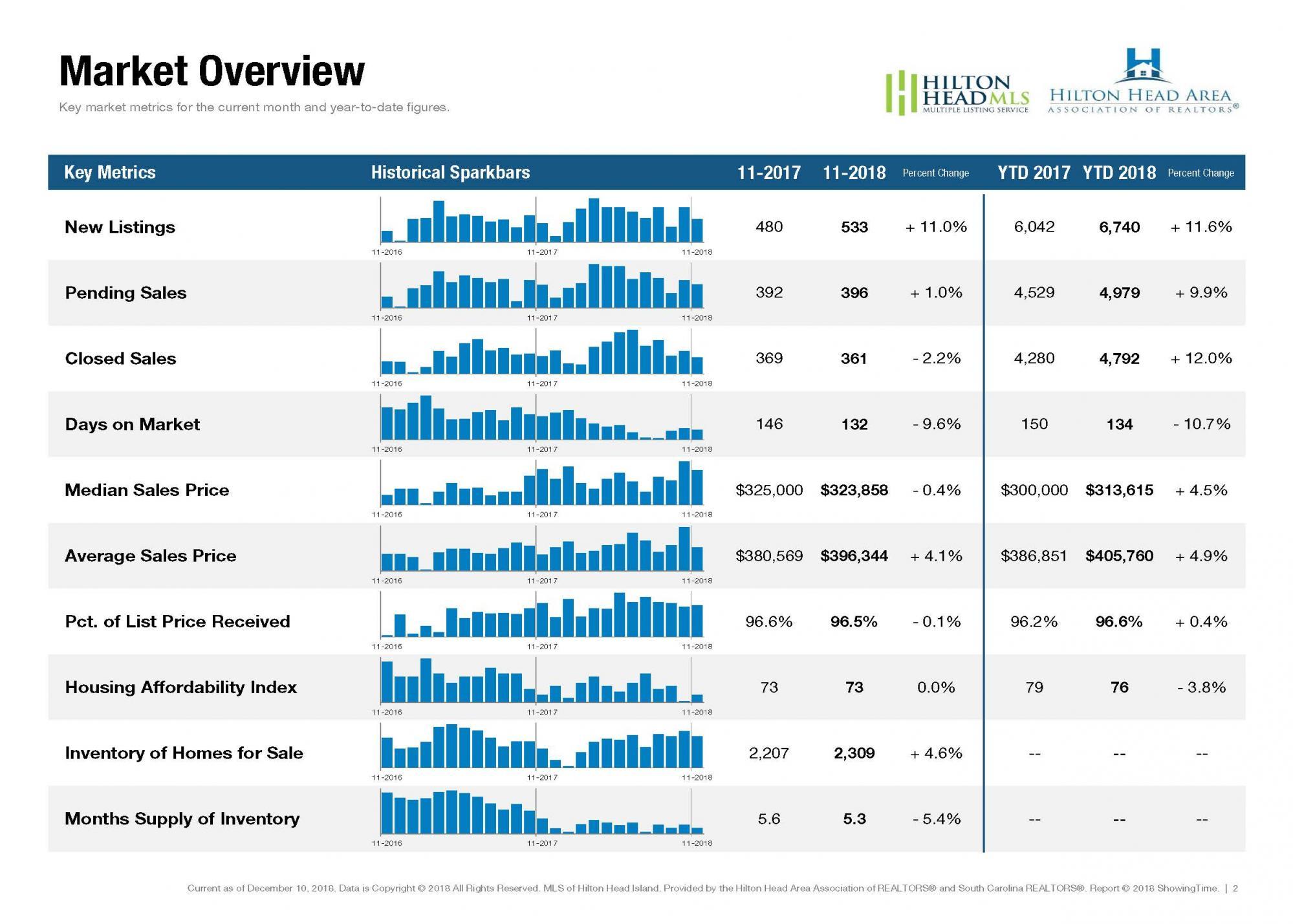

New Listings were up 11.0 percent to 533. Pending Sales increased 1.0 percent to 396. Inventory grew 4.6 percent to 2,309 units.

New Listings were up 11.0 percent to 533. Pending Sales increased 1.0 percent to 396. Inventory grew 4.6 percent to 2,309 units.

Prices were still soft as Median Sales Price was down 0.4 percent to $323,858. Days on Market decreased 9.6 percent to 132 days. Months Supply of Inventory was down 5.4 percent to 5.3 months, the tenth consecutive month of year-over-year declines.

The Bureau of Labor Statistics recently reported that the national unemployment rate was at 3.7 percent. Low unemployment has helped the housing industry during this extensive period of U.S. economic prosperity. Home buying and selling activity relies on gainful employment. It also relies on demand, and builders are showing caution by breaking ground on fewer single-family home construction projects in the face of rising mortgage rates and fewer showings.

Posted by Christina Galbreath-Gonzalez on

Leave A Comment