Despite a strong U.S. economy, historically low unemployment and steady wage growth, home sales began to slow across the nation late last year. Blame was given to a combination of high prices and a steady stream of interest rate hikes by the Federal Reserve. This month, the Fed responded to the growing affordability conundrum. In a move described as a patient approach to further rate changes, the Fed did not increase rates during January 2019.

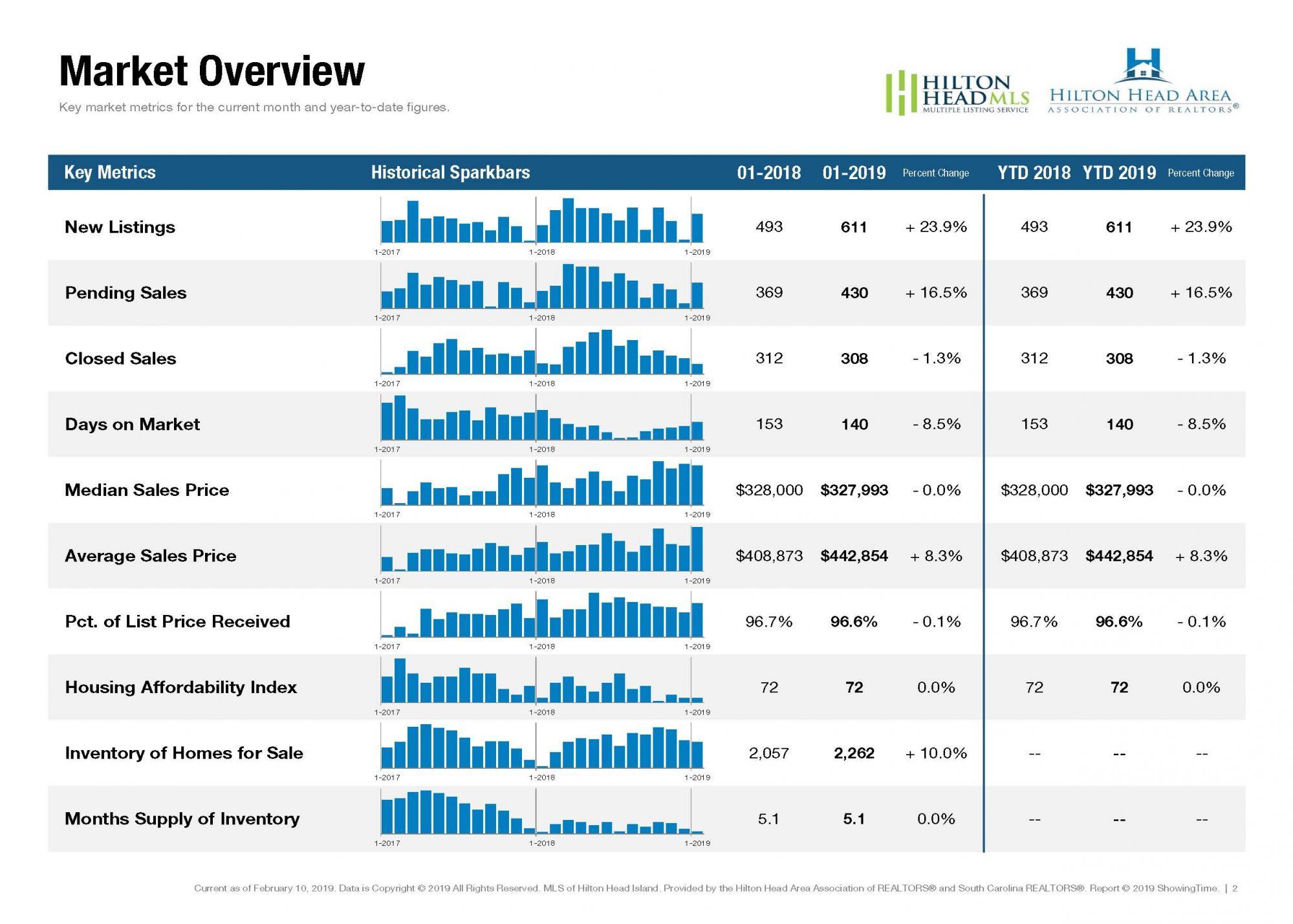

New Listings were up 23.9 percent to 611. Pending Sales increased 16.5 percent to 430. Inventory grew 10.0 percent to 2,262 units.

Prices were stable as Median Sales Price decreased slightly to $327,993. Days on Market decreased 8.5 percent to 140 days. Months Supply of Inventory remained flat at 5.1

While the home affordability topic will continue to set the tone for the 2019 housing market, early signs point to an improving inventory situation, including in several markets that are beginning to show regular year-over-year percentage increases. As motivated sellers attempt to get a jump on annual goals, many new listings enter the market immediately after the turn of a calendar year. If home price appreciation falls more in line with wage growth, and rates can hold firm, consumer confidence and affordability are likely to improve.

Posted by Bill True on

Leave A Comment