As we progressed through February, the actual and expected impacts of COVID-19 continued to grow, with concerns of economic impact reaching the stock market in the last week of the month. As the stock market declined, so did mortgage rates, offering a bad news-good news situation. While short term declines in the stock market can sting, borrowers who lock in today’s low rates will benefit significantly in the long term.

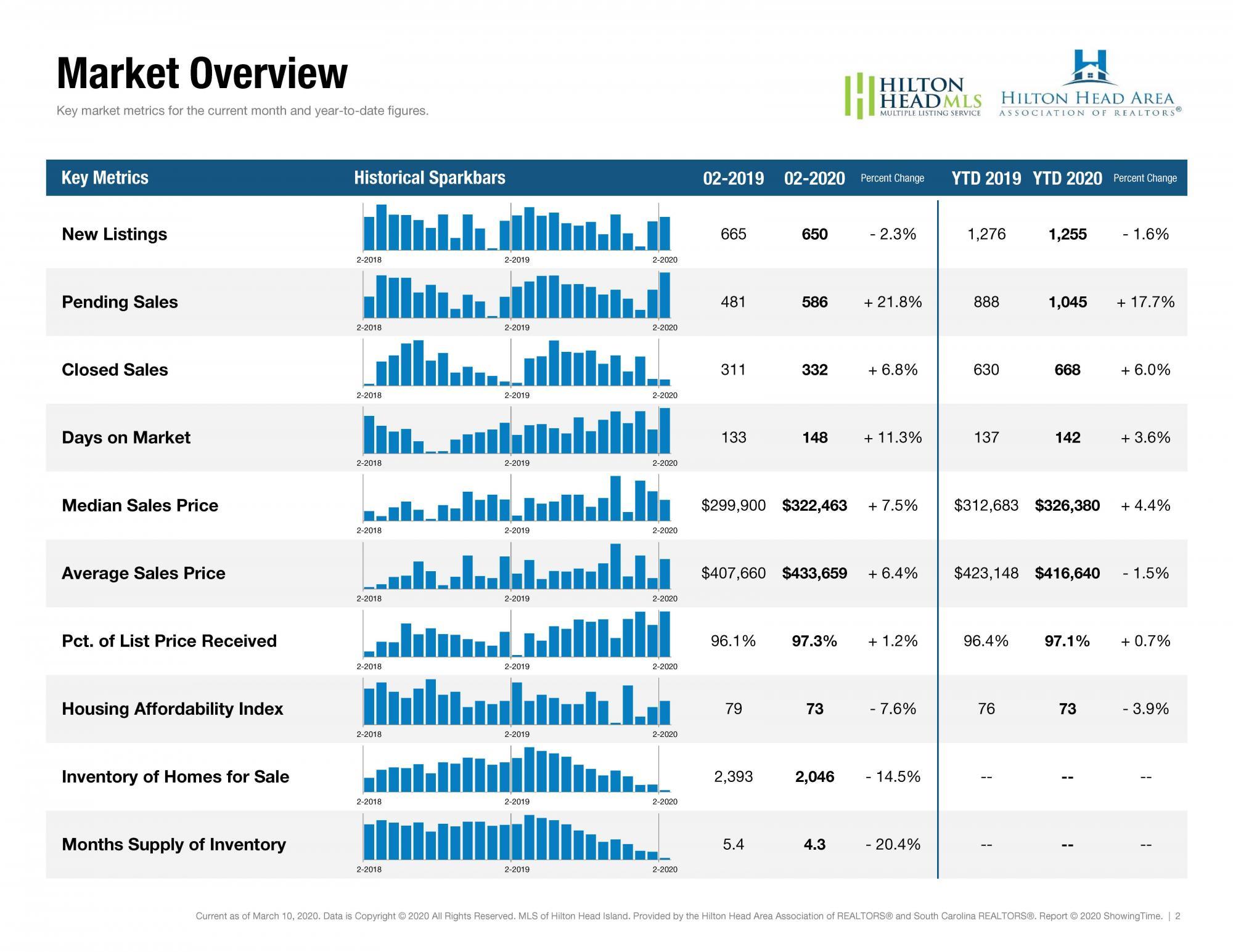

New Listings were down 2.3 percent to 650. Pending Sales increased 21.8 percent to 586. Inventory shrank 14.5 percent to 2,046 units.

Prices moved higher as Median Sales Price was up 7.5 percent to $322,463. Days on Market increased 11.3 percent to 148 days. Months Supply of Inventory was down 20.4 percent to 4.3 months, indicating that demand increased relative to supply.

The recently released January ShowingTime Showing Index® saw a 20.2 percent year-over-year increase in showing traffic nationwide. All regions of the country were up double digits from the year before, with the Midwest Region up 15.7 percent and the West Region up 34.1 percent. As showing activity is a leading indicator for future home sales, the 2020 housing market is off to a strong start, though it will be important to watch the spread of COVID-19 and its potential impacts to the overall economy in the coming months.

Posted by Bill True on

Leave A Comment