February 2018 Market Report

Posted by Christina Galbreath-Gonzalez on

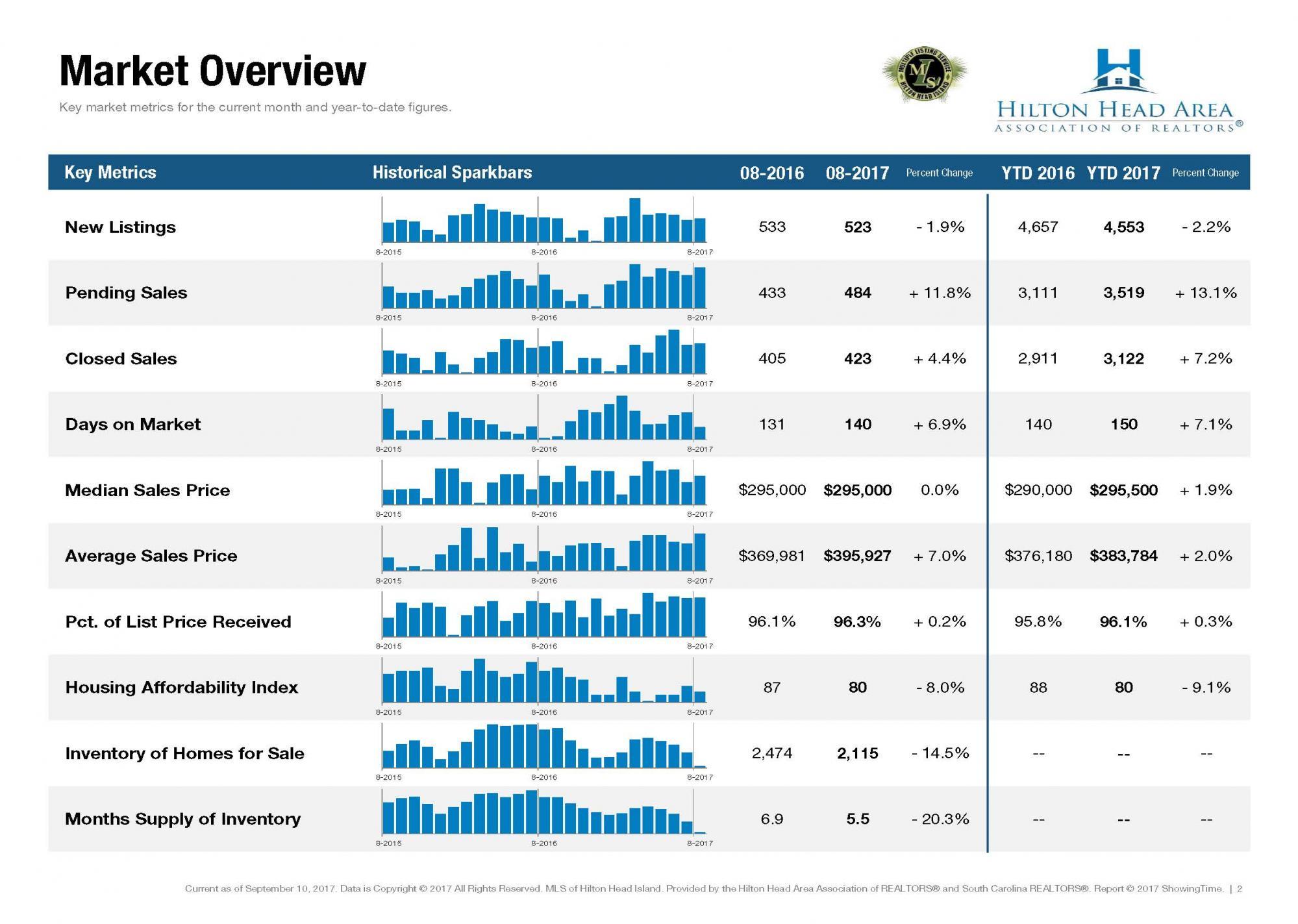

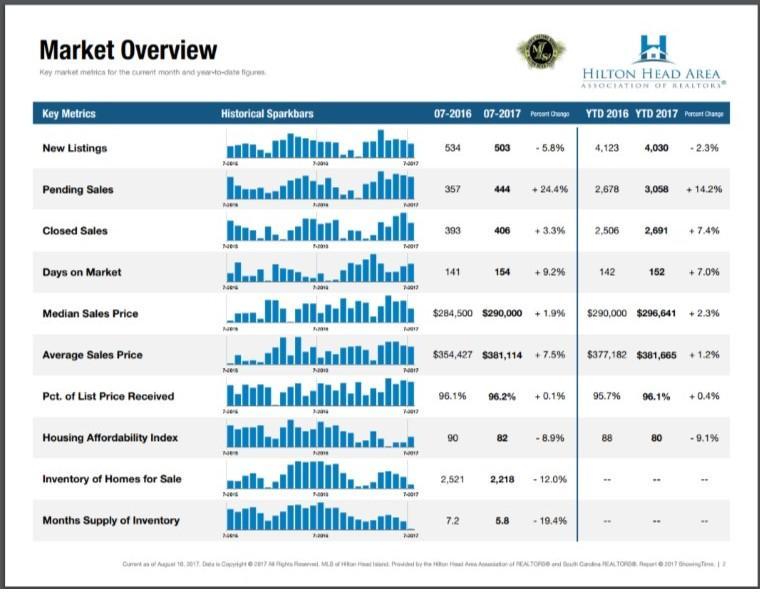

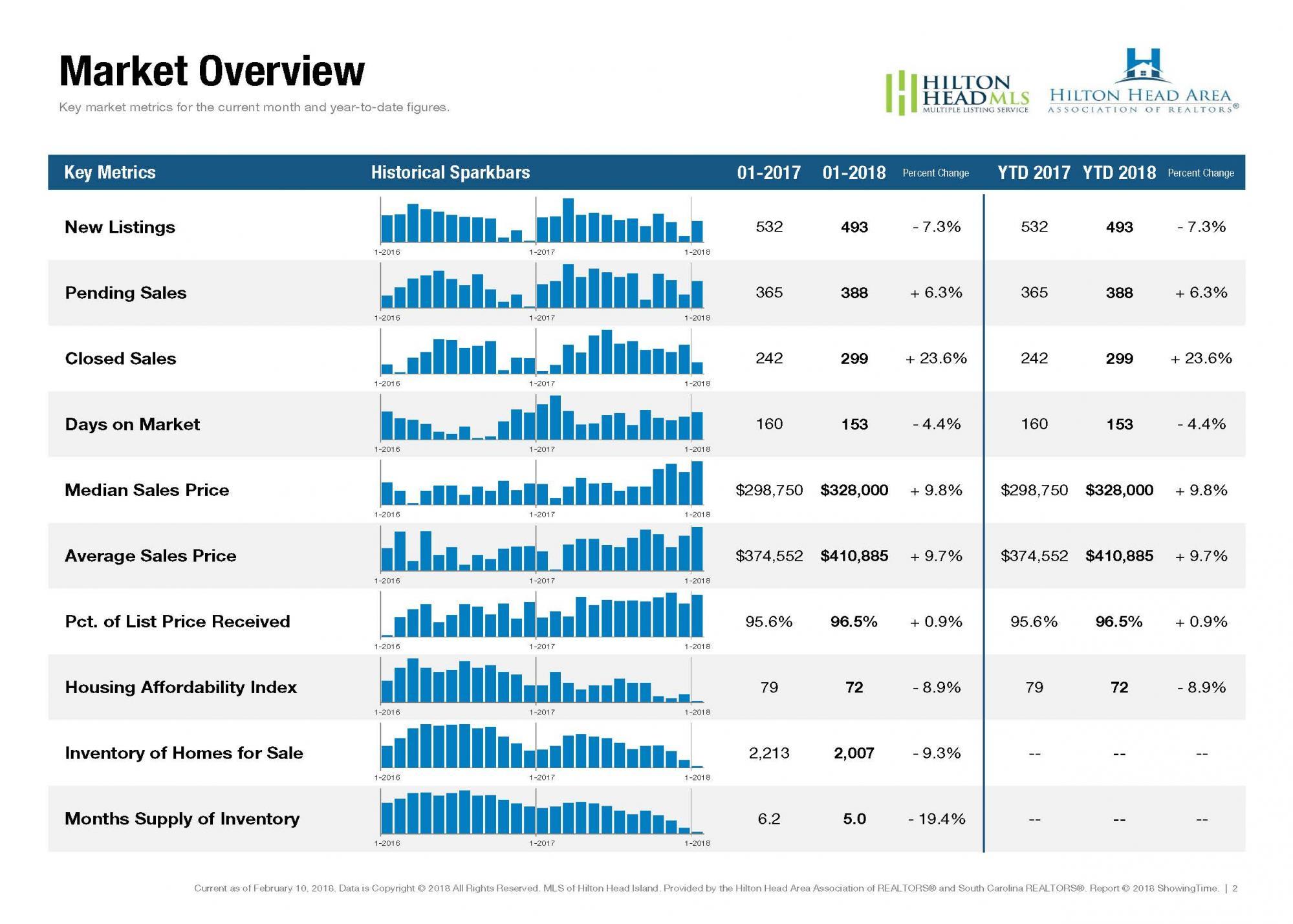

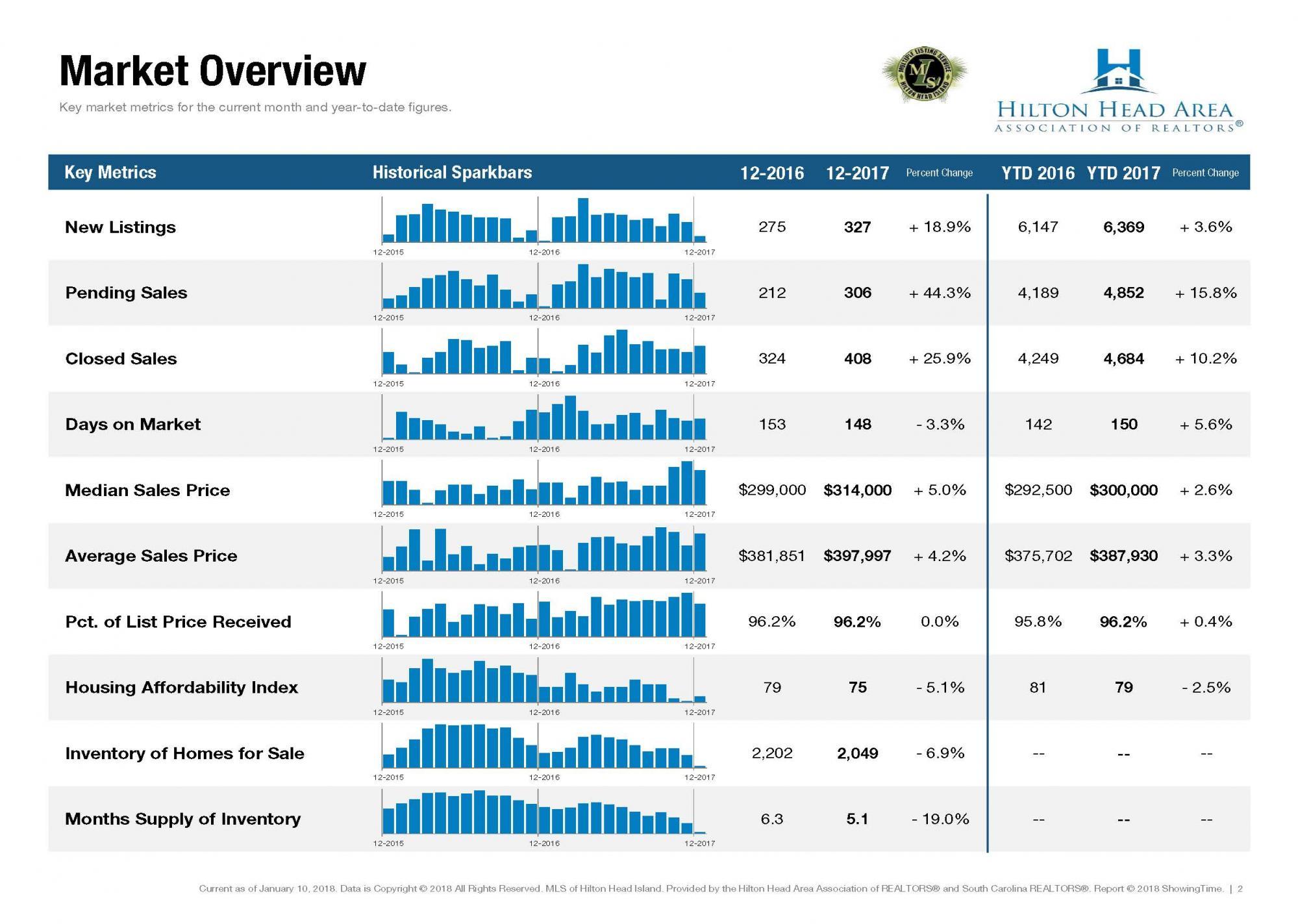

The three most prominent national market trends for residential real estate are the ongoing lack of abundant inventory, the steadily upward movement of home prices and year-over-year declines in home sales. Sales declines are a natural result of there being fewer homes for sale, but higher prices often indicate higher demand leading to competitive bidding. Markets are poised for increased supply, so there is hope that more sellers will take advantage of what appears to be a ready and willing buyer base.

- New Listings were up 19.5 percent to 650. Pending Sales increased 14.0 percent to 441. Inventory shrank 7.0 percent to 2,100 units.

- Prices moved higher as Median Sales Price was up 12.2 percent to $314,200. Days on Market decreased 13.7 percent to…

1286 Views, 0 Comments

Michael Fries is known in the real estate business for his fantastic customer service, his attention to detail, and his love for the low country. In addition to receiving his Seller Representative Specialist designation, he is also a certified Pricing Strategy Advisor. Prior to real estate, Fries was a Professional Golfer’s Association (PGA) Instructor which lends to his immense knowledge of the local golf communities. Learn more at MichaelFriesProperties.com or contact him today at MichaelFriesRealEstate@gmail.com

Michael Fries is known in the real estate business for his fantastic customer service, his attention to detail, and his love for the low country. In addition to receiving his Seller Representative Specialist designation, he is also a certified Pricing Strategy Advisor. Prior to real estate, Fries was a Professional Golfer’s Association (PGA) Instructor which lends to his immense knowledge of the local golf communities. Learn more at MichaelFriesProperties.com or contact him today at MichaelFriesRealEstate@gmail.com

Nov 2017.jpg)

_Page_02.jpg)

_Page_02.jpg)