Rising home prices, higher interest rates and increased building material costs have pressured housing affordability to a ten-year low, according to the National Association of Home Builders. Keen market observers have been watching this situation take shape for quite some time. Nationally, median household income has risen 2.6% in the last 12 months, while home prices are up 6.0%. That kind of gap will eventually create fewer sales due to affordability concerns, which is happening in several markets, especially in the middle to high-middle price ranges.

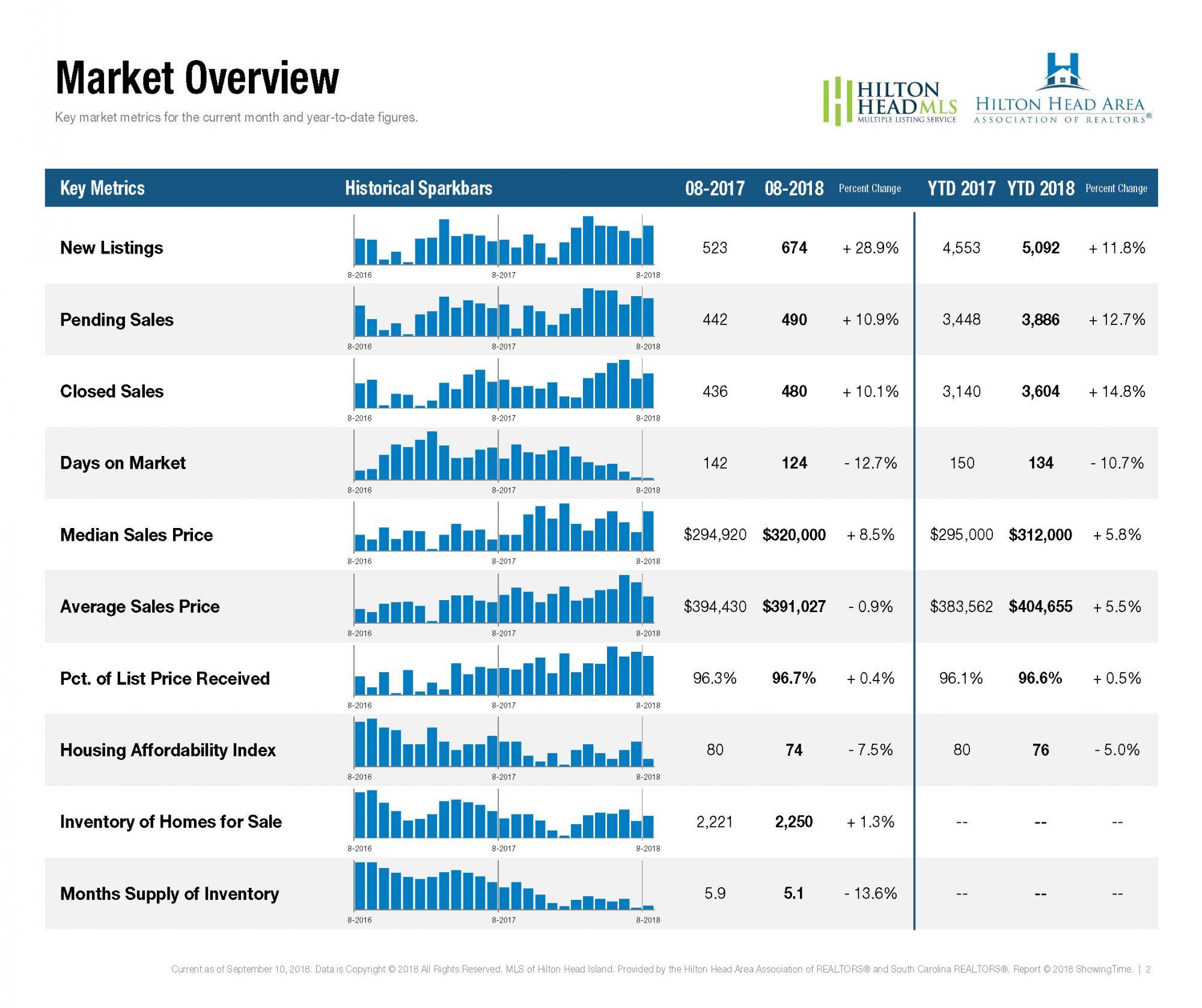

New Listings were up 28.9 percent to 674. Pending Sales increased 10.9 percent to 490, the seventh consecutive month of year-over-year gains. Inventory grew 1.3 percent to 2,250 units.

Prices moved higher as Median Sales Price was up 8.5 percent to $320,000. Days on Market decreased 12.7 percent to 124 days. Months Supply of Inventory was down 13.6 percent to 5.1 months, indicating that demand increased relative to supply.

While some are starting to look for recessionary signs like fewer sales, dropping prices and even foreclosures, others are taking a more cautious and research-based approached to their predictions. The fact remains that the trends do not yet support a dramatic shift away from what has been experienced over the last several years. Housing starts are performing admirably if not excitingly, prices are still inching upward, supply remains low and consumers are optimistic. The U.S. economy is under scrutiny but certainly not deteriorating.

Posted by Christina Galbreath-Gonzalez on

Leave A Comment